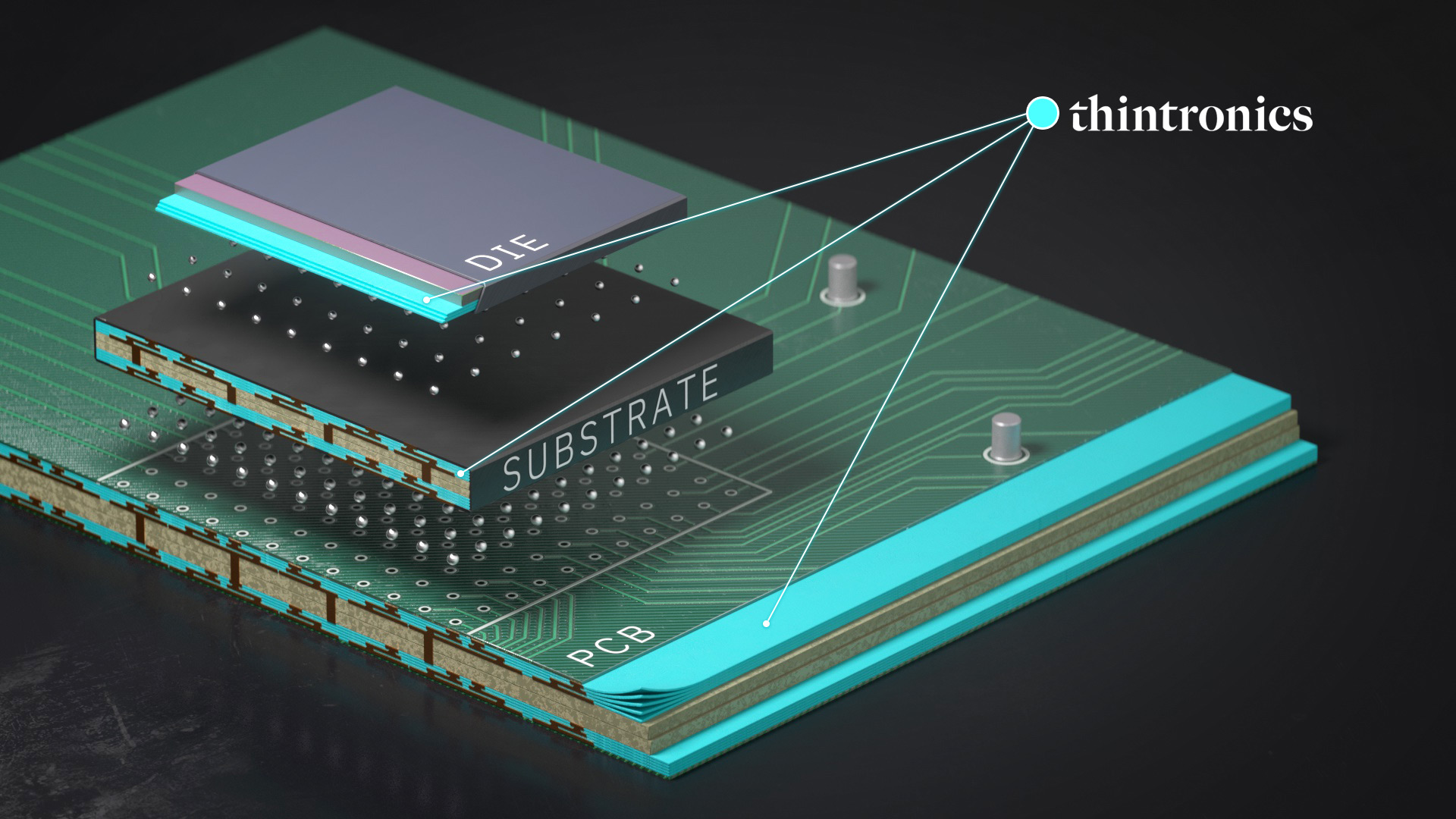

It may be dizzying to attempt to perceive all of the complicated parts of a single laptop chip: layers of microscopic parts linked to 1 one other by means of highways of copper wires, some barely wider than a number of strands of DNA. Nestled between these wires is an insulating materials known as a dielectric, guaranteeing that the wires don’t contact and brief out. Zooming in additional, there’s one explicit dielectric positioned between the chip and the construction beneath it; this materials, known as dielectric movie, is produced in sheets as skinny as white blood cells.

For 30 years, a single Japanese firm known as Ajinomoto has made billions producing this explicit movie. Rivals have struggled to outdo them, and at this time Ajinomoto has greater than 90% of the market within the product, which is utilized in every little thing from laptops to knowledge facilities.

However now, a startup primarily based in Berkeley, California, is embarking on a herculean effort to dethrone Ajinomoto and produce this small slice of the chipmaking provide chain again to the US.

Thintronics is promising a product purpose-built for the computing calls for of the AI period—a set of latest supplies that the corporate claims have increased insulating properties and, if adopted, might imply knowledge facilities with sooner computing speeds and decrease vitality prices.

The corporate is on the forefront of a coming wave of latest US-based corporations, spurred by the $280 billion CHIPS and Science Act, that’s in search of to carve out a portion of the semiconductor sector, which has turn out to be dominated by only a handful of worldwide gamers. However to succeed, Thintronics and its friends must overcome an internet of challenges—fixing technical issues, disrupting long-standing trade relationships, and persuading international semiconductor titans to accommodate new suppliers.

“Inventing new supplies platforms and getting them into the world could be very tough,” Thintronics founder and CEO Stefan Pastine says. It’s “not for the faint of coronary heart.”

The insulator bottleneck

When you acknowledge the identify Ajinomoto, you’re in all probability stunned to listen to it performs a vital position within the chip sector: the corporate is best referred to as the world’s main provider of MSG seasoning powder. Within the 1990s, Ajinomoto found {that a} by-product of MSG made an excellent insulator, and it has loved a close to monopoly within the area of interest materials ever since.

However Ajinomoto doesn’t make any of the opposite components that go into chips. In reality, the insulating supplies in chips depend on dispersed provide chains: one layer makes use of supplies from Ajinomoto, one other makes use of materials from one other firm, and so forth, with not one of the layers optimized to work in tandem. The ensuing system works okay when knowledge is being transmitted over brief paths, however over longer distances, like between chips, weak insulators act as a bottleneck, losing vitality and slowing down computing speeds. That’s lately turn out to be a rising concern, particularly as the dimensions of AI coaching will get costlier and consumes eye-popping quantities of vitality. (Ajinomoto didn’t reply to requests for remark.)

None of this made a lot sense to Pastine, a chemist who offered his earlier firm, which specialised in recycling laborious plastics, to an industrial chemical substances firm in 2019. Round that point, he began to consider that the chemical substances trade might be sluggish to innovate, and he thought the identical sample was holding chipmakers from discovering higher insulating supplies. Within the chip trade, he says, insulators have “form of been checked out because the redheaded stepchild”—they haven’t seen the progress made with transistors and different chip parts.

He launched Thintronics that very same yr, with the hope that cracking the code on a greater insulator might present knowledge facilities with sooner computing speeds at decrease prices. That concept wasn’t groundbreaking—new insulators are continually being researched and deployed—however Pastine believed that he might discover the correct chemistry to ship a breakthrough.

Thintronics says it can manufacture totally different insulators for all layers of the chip, for a system designed to swap into present manufacturing strains. Pastine tells me the supplies at the moment are being examined with numerous trade gamers. However he declined to supply names, citing nondisclosure agreements, and equally wouldn’t share particulars of the formulation.

With out extra particulars, it’s laborious to say precisely how effectively the Thintronics supplies examine with competing merchandise. The corporate lately examined its supplies’ Dk values, that are a measure of how efficient an insulator a fabric is. Venky Sundaram, a researcher who has based a number of semiconductor startups however will not be concerned with Thintronics, reviewed the outcomes. A few of Thintronics’ numbers have been pretty common, he says, however their most spectacular Dk worth is much better than something accessible at this time.

A rocky street forward

Thintronics’ imaginative and prescient has already garnered some assist. The corporate obtained a $20 million Sequence A funding spherical in March, led by enterprise capital corporations Translink and Maverick, in addition to a grant from the US Nationwide Science Basis.

The corporate can be in search of funding from the CHIPS Act. Signed into regulation by President Joe Biden in 2022, it’s designed to spice up corporations like Thintronics in an effort to convey semiconductor manufacturing again to American corporations and scale back reliance on international suppliers. A yr after it turned regulation, the administration stated that greater than 450 corporations had submitted statements of curiosity to obtain CHIPS funding for work throughout the sector.

The majority of funding from the laws is destined for large-scale manufacturing amenities, like these operated by Intel in New Mexico and Taiwan Semiconductor Manufacturing Company (TSMC) in Arizona. However US Secretary of Commerce Gina Raimondo has stated she’d prefer to see smaller corporations obtain funding as effectively, particularly within the supplies area. In February, functions opened for a pool of $300 million earmarked particularly for supplies innovation. Whereas Thintronics declined to say how a lot funding it was in search of or from which packages, the corporate does see the CHIPS Act as a significant tailwind.

However constructing a home provide chain for chips—a product that at the moment relies on dozens of corporations across the globe—will imply reversing many years of specialization by totally different international locations. And trade specialists say will probably be tough to problem at this time’s dominant insulator suppliers, who’ve usually needed to adapt to fend off new competitors.

“Ajinomoto has been a 90-plus-percent-market-share materials for greater than 20 years,” says Sundaram. “That is unheard-of in most companies, and you may think about they didn’t get there by not altering.”

One massive problem is that the dominant producers have decades-long relationships with chip designers like Nvidia or Superior Micro Units, and with producers like TSMC. Asking these gamers to swap out supplies is an enormous deal.

“The semiconductor trade could be very conservative,” says Larry Zhao, a semiconductor researcher who has labored within the dielectrics trade for greater than 25 years. “They like to make use of the distributors they already know very effectively, the place they know the standard.”

One other impediment going through Thintronics is technical: insulating supplies, like different chip parts, are held to manufacturing requirements so exact they’re tough to understand. The layers the place Ajinomoto dominates are thinner than a human hair. The fabric should additionally be capable to settle for tiny holes, which home wires working vertically by means of the movie. Each new iteration is a large R&D effort by which incumbent corporations have the higher hand given their years of expertise, says Sundaram.

If all that is accomplished efficiently in a lab, one more hurdle lies forward: the fabric has to retain these properties in a high-volume manufacturing facility, which is the place Sundaram has seen previous efforts fail.

“I’ve suggested a number of materials suppliers through the years that attempted to interrupt into [Ajinomoto’s] enterprise and couldn’t succeed,” he says. “All of them ended up having the issue of not being as simple to make use of in a high-volume manufacturing line.”

Regardless of all these challenges, one factor could also be working in Thintronics’ favor: US-based tech giants like Microsoft and Meta are making headway in designing their very own chips for the primary time. The plan is to make use of these chips for in-house AI coaching in addition to for the cloud computing capability that they hire out to prospects, each of which would cut back the trade’s reliance on Nvidia.

Although Microsoft, Google, and Meta declined to touch upon whether or not they’re pursuing developments in supplies like insulators, Sundaram says these corporations might be extra keen to work with new US startups quite than defaulting to the outdated methods of constructing chips: “They’ve much more of an open thoughts about provide chains than the prevailing massive guys.”