A group of brown pipes emerge at odd angles from the mud and overgrown grasses on a pine farm north of the tiny city of Tamarack, Minnesota.

Beneath these capped drill holes, Talon Metals has uncovered certainly one of America’s densest nickel deposits—and now it needs to start tunneling deep into the rock to extract a whole bunch of hundreds of metric tons of mineral-rich ore a 12 months.

If regulators approve the mine, it may mark the place to begin in what this mining exploration firm claims would grow to be the nation’s first full home nickel provide chain, operating from the bedrock beneath the Minnesota earth to the batteries in electrical autos throughout the nation.

That is the second story in a two-part sequence exploring the hopes and fears surrounding a single mining proposal in a tiny Minnesota city. You possibly can learn the primary half right here.

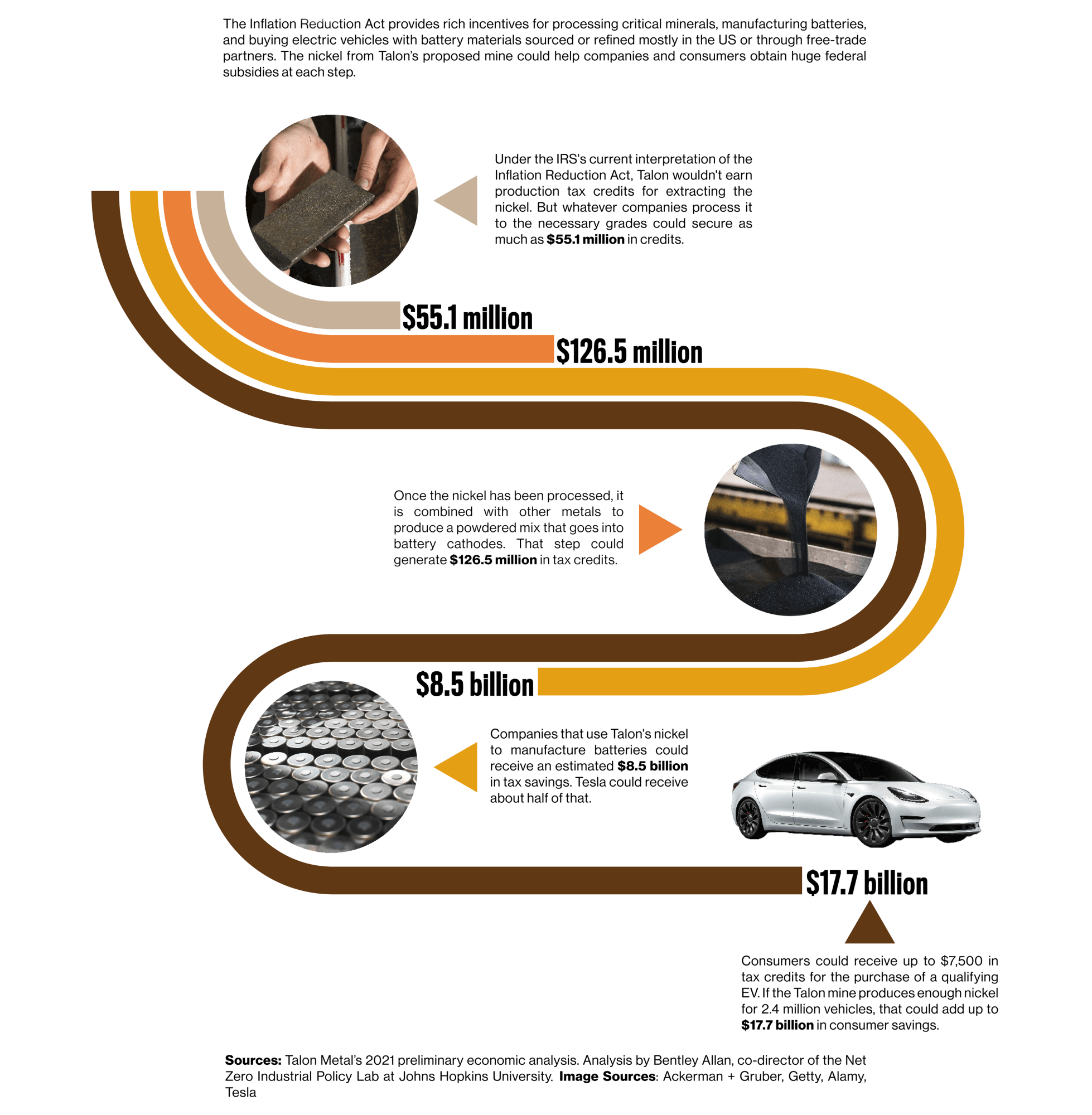

The US authorities is poised to offer beneficiant assist at each step, distributing tens of millions to billions of {dollars} in subsidies for these refining the metallic, manufacturing the batteries, and shopping for the vehicles and vans they energy.

The merchandise generated with the uncooked nickel that might circulate from this one mining venture may theoretically web greater than $26 billion in subsidies, simply by federal tax credit created by the Inflation Discount Act (IRA). That’s based on an authentic evaluation by Bentley Allan, an affiliate professor of political science at Johns Hopkins College and co-director of the Web Zero Industrial Coverage Lab, produced in coordination with MIT Expertise Evaluate.

One of many largest beneficiaries can be battery producers that use Talon’s nickel, which may safe greater than $Eight billion in tax credit. About half of that might go to the EV large Tesla, which has already agreed to buy tens of hundreds of metric tons of the metallic from this mine.

However the largest winner, a minimum of collectively, can be American shoppers who purchase EVs powered by these batteries. All advised, they might take pleasure in almost $18 billion in financial savings.

Whereas it’s been broadly reported that the IRA may unleash a minimum of a whole bunch of billions of federal {dollars}, MIT Expertise Evaluate needed to offer a clearer sense of the regulation’s on-the-ground affect by zeroing in on a single venture and inspecting how these wealthy subsidies may very well be unlocked at every level alongside the availability chain. (Learn my associated story on Talon’s proposal and the group response to it right here.)

We consulted with Allan to determine simply how a lot cash is doubtlessly in play, the place it’s prone to go, and what it might imply for rising industries and the broader economic system.

These calculations are all high-end estimates meant to evaluate the complete potential of the act, and so they assume that each firm and buyer qualifies for each tax credit score accessible at every level alongside the availability chain. Ultimately, the federal government nearly actually gained’t hand out the complete quantities that Allan calculated, given the various and sophisticated restrictions within the IRA and different components.

As well as, Talon itself might not get hold of any subsidies immediately by the regulation, based on current however not-yet-final IRS interpretations. However because of wealthy EV incentives that can stimulate demand for home vital minerals, the corporate nonetheless stands to learn not directly from the IRA.

How $26 billion in tax credit may break down throughout a brand new US nickel provide chain

The sheer scale of the numbers provide a glimpse into how and why the IRA, signed into regulation in August 2022, has already begun to drive initiatives, reconfigure sourcing preparations, and speed up the shift away from fossil fuels.

Certainly, the insurance policies have dramatically altered the mathematics for companies contemplating whether or not, the place, and when to construct new services and factories, serving to to spur a minimum of tens of billions of {dollars}’ price of personal investments into the nation’s critical-mineral-to-EV provide chain, based on a number of analyses.

“Should you attempt to work out the mathematics on these for 5 minutes, you begin to be actually shocked by what you see on paper,” Allan says, noting that the IRA’s incentives be certain that many extra initiatives may very well be profitably and competitively developed within the US. “It’s going to rework the nation in a severe means.”

An pressing recreation of catch-up

For many years, the US steadily offshored the messy enterprise of mining and processing metals, leaving different nations to take care of the environmental harm and group conflicts that these industries typically trigger. However the nation is more and more desirous to revitalize these sectors as local weather change and simmering commerce tensions with China elevate the financial, environmental, and geopolitical stakes.

Essential minerals like lithium, cobalt, nickel, and copper are the engine of the rising clean-energy economic system, important for producing photo voltaic panels, wind generators, batteries, and EVs. But China dominates manufacturing of the supply supplies, parts, and completed items for many of those merchandise, following many years of strategic authorities investments and focused commerce insurance policies. It refines 71% of the kind of nickel used for batteries and produces greater than 85% of the world’s battery cells, based on Benchmark Mineral Intelligence.

The US is now in a high-stakes scramble to catch up and guarantee its unfettered entry to those supplies, both by boosting home manufacturing or by locking in provide chains by pleasant buying and selling companions. The IRA is the nation’s largest wager, by far, on bolstering these industries and countering China’s dominance over world cleantech provide chains. By some estimates, it may unlock greater than $1 trillion in federal incentives.

“It ought to be ample to drive transformational progress in clean-energy adoption in america,” says Kimberly Clausing, a professor on the UCLA Faculty of Regulation who beforehand served as deputy assistant secretary for tax evaluation on the Treasury Division. “One of the best modeling appears to point out it is going to scale back emissions considerably, getting us midway to our Paris Settlement objectives.”

Amongst different subsidies, the IRA supplies tax credit that firms can earn for producing vital minerals, electrode supplies, and batteries, enabling them to considerably minimize their federal tax obligations.

However the provisions which might be actually driving the rethinking of sourcing and provide chains are the so-called home content material necessities contained within the tax credit for buying EVs. For shoppers to earn the complete credit, and for EV makers to learn from the enhance in demand they’ll generate, a big share of the vital minerals the batteries comprise should be produced within the US, sourced from free-trade companions, or recycled in North America, amongst different necessities.

This makes the vital minerals popping out of a mine like Talon’s particularly helpful to US automobile firms because it may assist be certain that their EV fashions and prospects qualify for these credit.

Mining and refining

Nickel, just like the deposits present in Minnesota, is of explicit significance for cleansing up the auto sector. The metallic boosts the quantity of vitality that may be packed into battery cathodes, extending the vary of vehicles and making attainable heavier electrical autos, like vans and even semis.

International nickel demand may rise 112% by 2040, based on the Worldwide Vitality Company, owing primarily to an anticipated ninefold improve in demand for EV batteries. However there’s just one devoted nickel mine working within the US in the present day, and most processing of the metallic occurs abroad.

In a preliminary financial evaluation of the proposed mine launched in 2021, Talon mentioned it hoped to dig up almost 11 million metric tons of ore over a nine-year interval, together with greater than 140,000 tons of nickel. That’s sufficient to supply lithium-ion batteries that might energy nearly 2.four million electrical autos, Allan finds.

After Talon mines the ore, the corporate plans to ship the fabric greater than 400 miles west by rail to a deliberate processing website in central North Dakota that might produce what’s referred to as “nickel in focus,” which is usually round 10% pure.

However that’s not sufficient to earn any subsidies below the present interpretation of the IRA’s tax credit score for critical-mineral manufacturing. The regulation specifies that an organization should convert nickel right into a extremely refined kind referred to as “nickel sulphate” or course of the metallic to a minimum of 99% purity by mass to be eligible for tax credit that cowl 10% of the working value. Allan estimates that whichever firm or firms perform that step may earn subsidies that exceed $55 million.

From there, the nickel would nonetheless must be processed and blended with different metals to supply the “cathode energetic supplies” that go right into a battery. No matter firms perform that step may safe some share of one other $126.5 million in tax financial savings, because of a separate credit score overlaying 10% of the prices of producing these supplies, Allan notes.

Some share of the subsidies from these two tax credit may go to Tesla, which has pressured that it’s bringing extra points of battery manufacturing in-house. For example, it’s within the strategy of establishing its personal lithium refinery and cathode plant in Texas.

However it’s not but clear what different firms may very well be concerned in processing the nickel mined by Talon and, thus, who would profit from these explicit provisions.

Talon and different mining firms have campaigned to have the prices for mining uncooked supplies included within the critical-mineral manufacturing tax credit score, however the IRS not too long ago acknowledged in a proposed rule that this step gained’t qualify.

Todd Malan, Talon’s chief exterior affairs officer and head of local weather technique, argues that this and different current determinations will restrict the incentives for firms to develop new mines within the US, or to ensure that any mines which might be developed meet the upper environmental and labor requirements the Biden administration and others have been calling for.

(The determinations may change because the Treasury Division and IRS have mentioned they’re nonetheless contemplating together with the prices of mining within the tax credit. They’ve requested further feedback on the matter.)

Even when Talon doesn’t get hold of any IRA subsidies, it nonetheless stands to earn federal funds in a number of different methods. The corporate is about to obtain a virtually $115 million grant from the Division of Vitality to construct the North Dakota processing website, by funds freed up below the Bipartisan Infrastructure Regulation. As well as, in September Talon secured almost $21 million in matching grants by the Protection Manufacturing Act, which can assist additional nickel exploration in Minnesota and at one other website the corporate is evaluating in Michigan. (These numbers should not included in Allan’s total $26 billion estimate.)

Talon Metals may obtain $136 million in federal subsidies

The mathematics

Allan says that his findings are finest considered ballpark figures. A few of Talon’s estimates have already modified, and the precise mineral portions and working prices will rely upon quite a lot of components, together with how the corporate’s plans shift, what state and native regulators in the end approve, what Talon really pulls out of the bottom, how a lot nickel the ore accommodates, and the way a lot prices shift all through the availability chain within the coming years.

His evaluation assumes a preparation value of $6.68 per kilowatt-hour for cathode energetic supplies, primarily based on an earlier evaluation within the journal Energies. It didn’t consider any potential subsidies related to different metals that Talon might extract from the mine, equivalent to iron, copper, and cobalt. Please see his full analysis temporary on the Web Zero Industrial Coverage Lab website.

Corporations can use the IRA tax credit to scale back and even eradicate their federal tax obligations, each now and in tax years to return. As well as, companies can switch and promote the tax credit to different taxpayers.

Many of the tax credit within the IRA start to part out in 2030, so firms want to maneuver quick to make the most of them. The subsidies for critical-mineral manufacturing, nonetheless, don’t have any such cutoff.

The place will the cash go and what is going to it do?

The $136 million in direct federal grants would double Talon’s funds for exploratory drilling efforts and canopy about 27% of the event value for its North Dakota processing plant.

The corporate says that these initiatives will assist speed up the nation’s shift towards EVs and scale back the nation’s reliance on China for vital minerals. Additional, Talon notes the mine will present vital native financial advantages, together with about 300 new jobs. That’s along with the almost 100 workers already working in or close to Tamarack. The corporate additionally expects the operation to generate almost $110 million in mineral royalties and taxes paid to the state, native authorities, and the regional college district.

Loads of residents round Tamarack, nonetheless, argue that any financial advantages will include steep trade-offs by way of environmental and group impacts. A lot of native tribal members worry the venture may contaminate waterways and hurt the area’s vegetation and animals.

“The vitality transition can’t be constructed by desecrating native lands,” mentioned Leanna Goose, a member of the Leech Lake Band of Ojibwe, in an electronic mail. “If these ‘vital’ minerals go away the bottom and are taken out from on or close to our reservations, our folks can be left with polluted water and land.”

In the meantime, because it turns into clear simply how a lot federal cash is at stake, opposition to the IRA and different climate-related legal guidelines is hardening. Congressional Republicans, a few of whom have portrayed the tax subsidies as company handouts to the “rich and effectively linked,” have repeatedly tried to repeal key provisions of the legal guidelines. As well as, some environmentalists and left-wing critics have chided the federal government for providing beneficiant subsidies to controversial firms and initiatives, together with Talon’s.

Talon stresses that it has made vital efforts to restrict air pollution and tackle Indigenous issues. As well as, Malan pushed again on Allan’s findings. He says the general estimate of $26 billion in subsidies throughout the availability chain considerably exaggerates the doubtless end result, given quite a few ways in which firms and shoppers may fail to qualify for the tax credit.

“I believe it’s an excessive amount of to tie it again to a bit of mining firm in Minnesota,” he says.

He emphasizes that Talon will earn cash just for promoting the metallic it extracts, and that it’s going to obtain different federal grants provided that it secures permits to proceed on its initiatives. (The corporate may additionally apply to obtain separate IRA tax credit that cowl a portion of the investments made into sure forms of vitality initiatives, but it surely has not presently.)

Boosting the battery sector

The following cease within the provide chain is the battery makers.

The quantity of nickel that Talon expects to drag from the mine may very well be used to supply cathodes for almost 190 million kilowatt-hours’ price of lithium-ion batteries, based on Allan’s findings.

Manufacturing that many batteries may generate some $8.5 billion from a pair of IRA tax credit price $45 per kilowatt-hour, dwarfing the potential subsidies for processing the nickel.

Any variety of firms may buy metals from Talon to construct batteries, however Tesla has already agreed to purchase 75,000 tons of nickel in focus from the North Dakota facility. (The businesses haven’t disclosed the monetary phrases of the deal.)

Given the batteries that may very well be produced with this quantity of metallic, Tesla’s share of those tax financial savings may exceed $four billion, Allan discovered.

The tax credit add as much as “a 3rd of the price of the battery, full cease,” he says. “These are massive numbers. The whole value of constructing the plant, a minimum of, is roofed by the IRA.”

What Talon’s nickel might imply for Tesla

The mathematics

The subsidies for battery makers would circulate from two credit throughout the IRA. These embrace a $35-per-kilowatt-hour tax credit score for manufacturing battery cells and a $10-per-kilowatt-hour credit score for producing battery modules, that are the bundles of interoperating cells that slot into autos. Allan’s calculations assume that each one the metallic might be used to supply nickel-rich NMC 811 batteries, and that each EV will embrace an 80-kilowatt-hour battery pack that prices $153 per kilowatt-hour to supply.

The place will the cash go and what is going to it do?

These billions are simply what Tesla may safe in tax credit from the nickel it buys from Talon. It and different battery makers may qualify for nonetheless extra authorities subsidies for batteries produced with vital minerals from different sources.

Tesla didn’t reply to inquiries from MIT Expertise Evaluate. However its executives have mentioned they consider Tesla’s batteries will qualify for the manufacturing tax credit, even earlier than Talon’s mining and processing vegetation are up and operating.

On an earnings name final January, Zachary Kirkhorn, who was then the corporate’s chief monetary officer, mentioned that Tesla anticipated the battery subsidies from its present manufacturing traces to complete $150 million to $250 million per quarter in 2023. He mentioned the corporate intends to make use of the tax credit to decrease costs and promote larger adoption of electrical autos: “We wish to use this to speed up sustainable vitality, which is our mission and in addition the aim of [the IRA].”

However these potential subsidies are clear proof that the US authorities is dedicating funds to the flawed societal priorities, says Jenna Yeakle, an organizer for the Sierra Membership North Star Chapter in Minnesota, which added its identify to a letter to the White Home criticizing federal assist for Talon’s proposals.

“Persons are struggling to pay lease and put meals on the desk and to navigate our monopolized company health-care system,” she says. “Can we must be subsidizing Elon Musk’s checking account?”

Nonetheless, the IRA’s tax credit will go to quite a few battery firms past Tesla.

In truth, the incentives are already reshaping {the marketplace}, driving a pointy improve within the variety of battery and electric-vehicle initiatives introduced, based on the EV Provide Chain Dashboard, a database managed by Jay Turner, a professor of environmental research at Wellesley School and writer of Charged: A Historical past of Batteries and Classes for a Clear Vitality Future.

As of press time, 81 battery and EV-related initiatives representing $79 billion in investments and greater than 50,000 jobs have been introduced throughout the US since Biden signed the IRA. On an annual foundation, that’s almost 3 times the typical greenback figures introduced in recent times earlier than the regulation was enacted. The initiatives embrace BMW, Hyundai, and Ford battery vegetation, Tesla’s semi manufacturing pilot plant in Nevada, and Redwoods Supplies’ battery recycling facility in South Carolina.

“It’s actually distinctive,” Turner says. “I don’t suppose anyone anticipated to see so many battery initiatives, so many roles, and so many investments over the previous 12 months.”

Driving EV gross sales

The most important subsidy, although additionally probably the most diffuse one, would go to American shoppers.

The IRA gives two tax credit price as much as $7,500 mixed for buying EVs and plug-in hybrids if the battery supplies and parts adjust to the home content material necessities.

Because the nickel that Talon expects to extract from the Minnesota mine may energy almost 2.four million electrical autos, shoppers may collectively see $17.7 billion in potential financial savings if all these autos qualify for each credit, Allan finds.

Talon’s Malan says this estimate considerably overstates the doubtless client financial savings, noting that many purchases gained’t qualify. Certainly, a person with a gross earnings that exceeds $150,000 gained’t be eligible, nor will pickups, vans, and SUVs that value greater than $80,000. That might rule out, as an illustration, the high-end mannequin of Tesla’s Cybertruck.

A lot of Tesla fashions are presently excluded from one or each client credit, for various and complicated causes. However the Talon deal and different current sourcing preparations, in addition to the corporate’s plans to fabricate extra of its personal batteries, may assist extra of Tesla’s autos to qualify within the coming months or years.

The IRA’s client incentives are prone to do extra to stimulate demand than earlier federal EV insurance policies, largely as a result of prospects can take them within the type of a value minimize on the level of sale, says Gil Tal, director of the Electrical Car Analysis Middle on the College of California, Davis. Beforehand, such incentives would merely scale back the client’s federal obligations come tax season.

RMI, a nonprofit analysis group targeted on clear vitality, initiatives that each one the EV provisions throughout the IRA, which additionally embrace subsidies for brand spanking new charging stations, will spur the gross sales of an extra 37 million electrical vehicles and vans by 2032. That might propel EV gross sales to round 80% of latest passenger-automobile purchases. These autos, in flip, may eradicate 2.four billion tons of transportation emissions by 2040.

The mathematics

The IRA gives two tax credit that might apply to EV consumers. The primary is a $3,750 credit score for many who buy autos with batteries that comprise a good portion of vital minerals that had been mined or processed within the US, or in a rustic with which the US has a free-trade settlement. The required share is 50% in 2024 however reaches 80% starting in 2027. Vehicles and vans can also qualify if the supplies got here from recycling in North America.

Consumers can even earn a separate $3,750 credit score if a specified share of the battery parts within the automobile had been manufactured or assembled in North America. The share is 60% this 12 months and subsequent however reaches 100% in 2029.

The massive wager

There are lingering questions on how lots of the initiatives sparked by the nation’s new inexperienced industrial insurance policies will in the end be constructed—and what the US will get for all the cash it’s giving up.

In spite of everything, the tens of billions of {dollars}’ price of tax credit that may very well be granted all through the Talon-to-Tesla-to-consumer nickel provide chain is cash that isn’t going to the federal authorities, and isn’t funding companies for American taxpayers.

The IRA’s impacts on tax coffers are sure to return below larger scrutiny because the applications ramp up, the greenback figures rise, initiatives run into hassle, and the businesses or executives benefiting have interaction in questionable practices. In spite of everything, that’s precisely what occurred within the aftermath of the nation’s first main inexperienced industrial coverage efforts a decade in the past, when the high-profile failures of Solyndra, Fisker, and different government-backed clean-energy ventures fueled outrage amongst conservative critics.

Nonetheless, Tom Moerenhout, a analysis scholar at Columbia College’s Middle on International Vitality Coverage, insists it’s flawed to think about these tax credit as forgone federal income.

In lots of instances, the initiatives set to get subsidies for 10% of their working prices wouldn’t in any other case have existed within the first place, since these processing vegetation and manufacturing services would have been in-built different, cheaper nations. “They’d merely go to China,” he says.

UCLA’s Clausing doesn’t completely agree with that take, noting that a few of this cash will go to initiatives that might have occurred anyway, and among the sources will merely be pulled from different sectors of the economic system or completely different venture varieties.

“It doesn’t behoove us as specialists to argue that is free cash,” she says. “Sources actually do have prices. Cash doesn’t develop on bushes.”

However any federal bills listed here are “nonetheless cheaper than the social value of carbon,” she provides, referring to the estimated prices from the harm related to ongoing greenhouse-gas air pollution. “And we should always hold our eyes on the prize and keep in mind that there are some social priorities price paying for—and that is a kind of.”

Ultimately, few anticipate the US’s sweeping local weather legal guidelines to fully obtain any of the hopes underlying them on their very own. They gained’t propel the US to net-zero emissions. They gained’t allow the nation to shut China’s large lead in key minerals and cleantech, or totally break away from its reliance on the rival nation. In the meantime, the battle to lock down entry to vital minerals will solely grow to be more and more aggressive as extra nations speed up efforts to maneuver away from fossil fuels—and it’ll generate much more controversy as communities push again towards proposals over issues about environmental destruction.

However the proof is constructing that the IRA specifically is spurring actual change, delivering a minimum of some progress on a lot of the objectives that drove its passage: galvanizing green-tech initiatives, slicing emissions, creating jobs, and shifting the nation nearer to its clean-energy future.

“It’s catalyzing funding up and down the availability chain throughout North America,” Allan says. “It’s a big shot within the arm of American trade.”