A recession is already priced in, and what comes subsequent is a giant inventory rally the place the whole market tends to roar 15- to 25%.

- The Recession Purchase Indicator broadly states that one of the best time to purchase shares in a recession-driven selloff is about seven months in, across the time everybody begins realizing the economic system is in tough form and will already be in a recession.

- Shares drop nicely earlier than a recession turns into apparent, they usually rebound nicely earlier than an financial restoration turns into apparent.

- Usually, you wish to purchase shares seven months right into a recession, as soon as the world begins pondering the economic system is definitely in a recession — which is the place we’re proper now, in response to the info.

- Now to say, there’s an enormous hole between inventory costs and analyst value targets, implying large upside potential in equities.

Everybody’s speaking concerning the U.S. economic system falling right into a recession. However consider it or not, it might already be in a single. And oddly sufficient, which may be one of the best purpose ever to purchase shares at present.

Observe me right here…

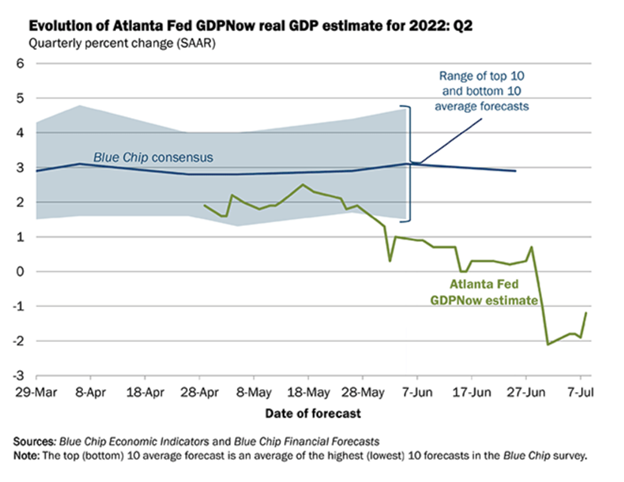

A recession is technically outlined as back-to-back quarters of unfavorable GDP progress. First-quarter GDP was unfavorable. Certain, it was unfavorable resulting from an odd commerce imbalance. But it surely was nonetheless unfavorable.

The Atlanta Fed’s real-time GDPNow mannequin is forecasting for second-quarter GDP to fall 1.2%. That might mark two consecutive quarters of unfavorable GDP progress for the U.S. economic system. If true, then the U.S. economic system technically entered a recession again in January.

Spooky, sure. However for traders, that realization really screams alternative.

Wall Avenue is at a degree on this selloff cycle the place, traditionally, the recession is already priced in. Usually, what comes subsequent is a giant inventory rally the place the whole market tends to roar 15- to 25%.

So, neglect all of the recession speak. That can scare the typical investor. Certainly, common traders are working away from the market. However good traders – those that offered again in December 2021 – at the moment are returning to the market. And so they’re already making ready for a giant rebound.

Briefly, it’s time to purchase the dip.

Right here’s a deeper look.

The Well-known Recession Purchase Indicator

One of many monetary world’s best-kept secrets and techniques is a largely unknown contrarian market indicator known as the “Recession Purchase Indicator.”

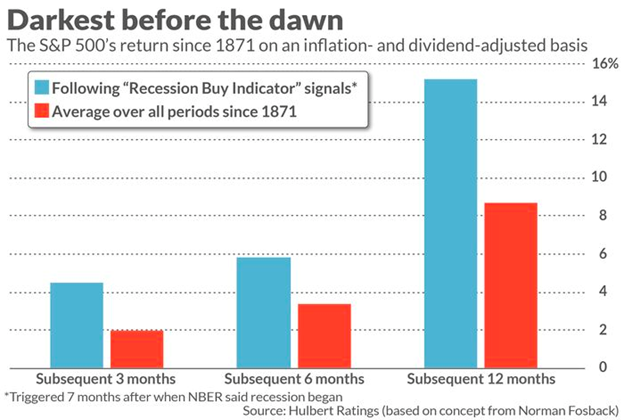

The Recession Purchase Indicator was developed by famend economist Norman Fosback within the 1970s. The idea broadly states that one of the best time to purchase shares in a recession-driven selloff is about seven months in. That’s across the time everybody begins realizing the economic system is in tough form and will already be in a recession.

The pondering is that as a result of the inventory market is a discounting mechanism, shares drop nicely earlier than a recession turns into apparent. And so they rebound nicely earlier than an financial restoration turns into apparent. Per Fosback’s analysis, this “inflection level” tends to occur about midway by way of a recession. That’s normally round month seven because the common recession is about 14 months lengthy.

The idea is extra than simply speak. It’s backed by 150 years of information.

Since 1870, shares have produced ~2X returns each time the Recession Purchase Indicator is triggered — seven months after the economic system entered a recession.

Common three-month returns? Over 4%, versus 2% for three-month home windows. Common six-month returns? About 6%, versus ~3% forever durations. Common 12-month returns? Round 15%, versus ~8% forever durations.

It’s Time to Purchase Now

The proof is evident. The Recession Purchase Indicator works. Usually, you wish to purchase shares seven months right into a recession, as soon as the world begins pondering the economic system is definitely in a recession.

And in response to the info, that’s precisely the place we’re at present.

It seems to be just like the U.S. economic system entered a recession in January. It’s July now — month seven. In the meantime, over the previous few weeks, each main monetary media outlet has been writing about how the U.S. economic system could also be in a recession.

The Recession Purchase Indicator is flashing proper now.

Traditionally, which means we’re within the midst of a nice shopping for alternative. And shares ought to energy meaningfully greater over the subsequent 12 months.

That’s bullish.

But it surely’s removed from the one bullish indicator flashing proper now.

Analyst Value Targets Suggest 25%-Plus Returns

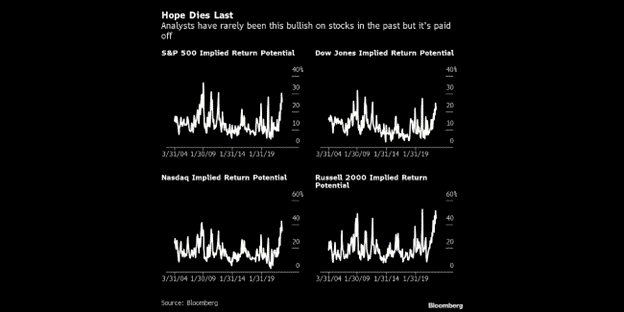

Whereas shares have crashed over the previous eight months, Wall Avenue analysts have remained resolutely optimistic.

In different phrases, inventory costs have dropped rather a lot in 2022. However inventory value targets haven’t dropped by a lot. The outcome? An enormous hole between inventory costs and value targets, implying large upside potential in equities.

This can be a uncommon incidence that’s exceptionally bullish.

Particularly, the analyst consensus value targets for numerous inventory market indices — the S&P 500, Dow Jones, Nasdaq, and Russell 2000 — are all 20%-plus above present index ranges. Such a big hole has solely occurred 4 occasions since 2000. Three of the Four occasions, shares rallied over the subsequent 12 months. The common acquire? A formidable 25%!

In different phrases, analysts are not often as bullish on shares as they’re proper now. After they have been this bullish earlier than, shares popped a mean of 25% over the subsequent 12 months.

Coupled with the Recession Purchase Indicator, this information constitutes a reasonably compelling “purchase the dip now” thesis.

The Closing Phrase on the Recession Purchase Indicator

Shares have been crushed this 12 months. Consequently, a lot of traders are working away from the markets to cover from the harm. However there’s a rising mountain of proof that means the worst of the market selloff over. And an enormous market rebound is on the horizon.

So, don’t run away from the markets. Run towards them. Purchase the dip in shares positioned to steer an enormous second-half rebound.

One such inventory is a tiny, $Three know-how inventory that I believe could also be the one most compelling 12-month funding alternative available in the market at present.

The world’s largest firm — Apple (AAPL) — is reportedly set to announce a brand-new product within the coming months.

No. I’m not speaking about one other iPhone, Apple Watch or iPad. I’m speaking about a completely new product that may very well be larger than all these merchandise mixed.

And per my evaluation, the corporate behind this $Three tech inventory is positioned to safe a partnership with Apple. It’ll provide a crucial piece of know-how to make this new product work.

Fast market tip: Apple provider shares don’t commerce for $3. Simply have a look at Skyworks (SWKS) inventory. That’s a serious iPhone elements provider. Its inventory is buying and selling for $100. However at one time limit, it was buying and selling for $3, too.

The tiny potential Apple provider inventory I’m speaking about may simply commerce for $100 within the close to future. And it’s simply $Three at present.

This can be a inventory you merely should hear about proper now.

Happily, it is usually a inventory I wish to inform you all about.

Revealed First on InvestorPlace. Learn Right here.

Internal Picture Credit score: Offered by the Writer; Thanks!

Function Picture:

The put up Secret Recession Indicator Factors to a Huge Inventory Market Rebound appeared first on ReadWrite.