A strong, uncommon phenomenon drives buyers’ wealth for very temporary moments in time and just for sure shares.

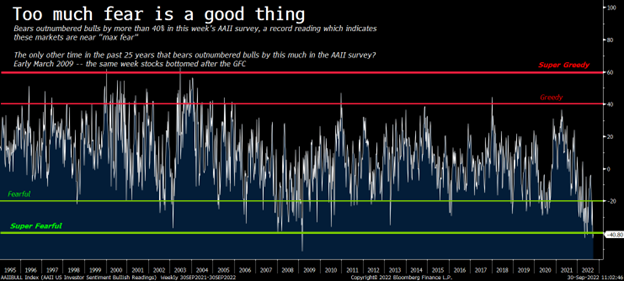

- For 2 weeks in a row, the proportion of bearish buyers in America has outnumbered the proportion of bullish buyers by greater than 40%. The final time this occurred was early March 2009 – the very same week shares bottomed after the 2008 monetary disaster!

- My group and I’ve found a uncommon inventory market phenomenon that happens about as soon as each 10 years, and it persistently represents the very best shopping for alternatives in U.S. inventory market historical past.

- Each time these divergences emerge, they flip into generational shopping for alternatives. Inventory costs “snap again” to elementary progress tendencies, and buyers who purchased the dip see their returns rocket.

- As a result of these alternatives emerge out of concern within the markets – and since we’ve reached peak concern – we’ve concluded that this ultra-rare funding alternative is quickly closing shut.

It’s been a loopy 12 months within the markets, huh? However what if I informed you that each one this craziness is definitely creating the money-making alternative of the century?

You’d be skeptical. And that’s superb. Simply don’t disregard me as a result of I’ve a ton of knowledge to show that declare. At present, we sit on the cusp of arguably the most important funding alternative within the inventory market… ever.

Sure, I’m conscious of all the issues the world is dealing with at the moment. A long time-high inflation. A U.S. Federal Reserve embarking on probably the most aggressive rate-hiking cycle in over 40 years. A conflict in Europe for the primary time since World Warfare II. The best gasoline costs and grocery costs in many years. The most important inventory market crash since 2008.

Discuss uncommon, unstable, scary.

Towards that backdrop, I wouldn’t blame you for eager to run for the hills and take cowl from the storm. However the nice Warren Buffett as soon as mentioned that it’s typically greatest to be grasping when others are fearful.

Everybody’s fearful proper now.

The American Affiliation of Particular person Traders weekly survey has discovered that for 2 weeks in a row, the proportion of bearish buyers in America has outnumbered the proportion of bullish buyers by greater than 40%. That’s an unusually excessive quantity which marks “peak concern.” Certainly, the web bull ratio has been this low solely as soon as earlier than, in early March 2009 – the very same week shares bottomed after the 2008 monetary disaster!

Let that sink in for a second…

There’s nothing however concern on the market. Buffett would inform us to get grasping right here. However ought to we heed these phrases of recommendation?

Completely.

Concern Can Be a Good Factor?

Over the previous a number of months, my group and I’ve been finding out the intricacies of inventory market crashes all through the historical past of recent capitalism – and we found one thing wonderful.

Particularly, we’ve found a uncommon inventory market phenomenon that happens about as soon as each 10 years. And it persistently represents the very best shopping for alternatives in U.S. inventory market historical past.

Greater than that, we discovered how you can quantitatively determine this phenomenon. Sure, now we have engineered a option to benefit from it for large earnings.

Properly, people, guess what’s occurring proper now?

This ultra-rare inventory market phenomenon has emerged. And our fashions are flashing vivid “Purchase” indicators.

I do know. That will sound fairly counterintuitive, contemplating what’s happening out there proper now.

However I’m staking my profession on this declare – as a result of it’s actually not an opinion. It’s a truth. Backed by knowledge, historical past, statistics and arithmetic. Backed by the most important market phenomenon in historical past.

So, I repeat: We stand on the cusp of a chance of a lifetime.

By now, you’re in all probability asking: OK, Luke, you’ve my consideration…however the place’s the proof?

Glad you requested as a result of I’ve numerous that. Let’s take a deep look.

Inventory Costs Comply with Fundamentals

To know the distinctive phenomenon my group and I’ve recognized, we have to first perceive the conduct patterns of shares.

Within the quick time period, shares are pushed by myriad components. These embody geopolitics, rate of interest, inflation, elections, recession fears, and so forth.

Huge image, nonetheless, shares are pushed by one factor and one factor solely: fundamentals.

That’s, on the finish of the day, revenues and earnings drive inventory costs. If an organization’s revenues and earnings pattern upward over time, then the corporate’s inventory worth will comply with swimsuit. Conversely, if an organization’s revenues and earnings pattern downward over time, then the corporate’s inventory worth will drop.

That will sound like an oversimplification. However, actually, it’s not.

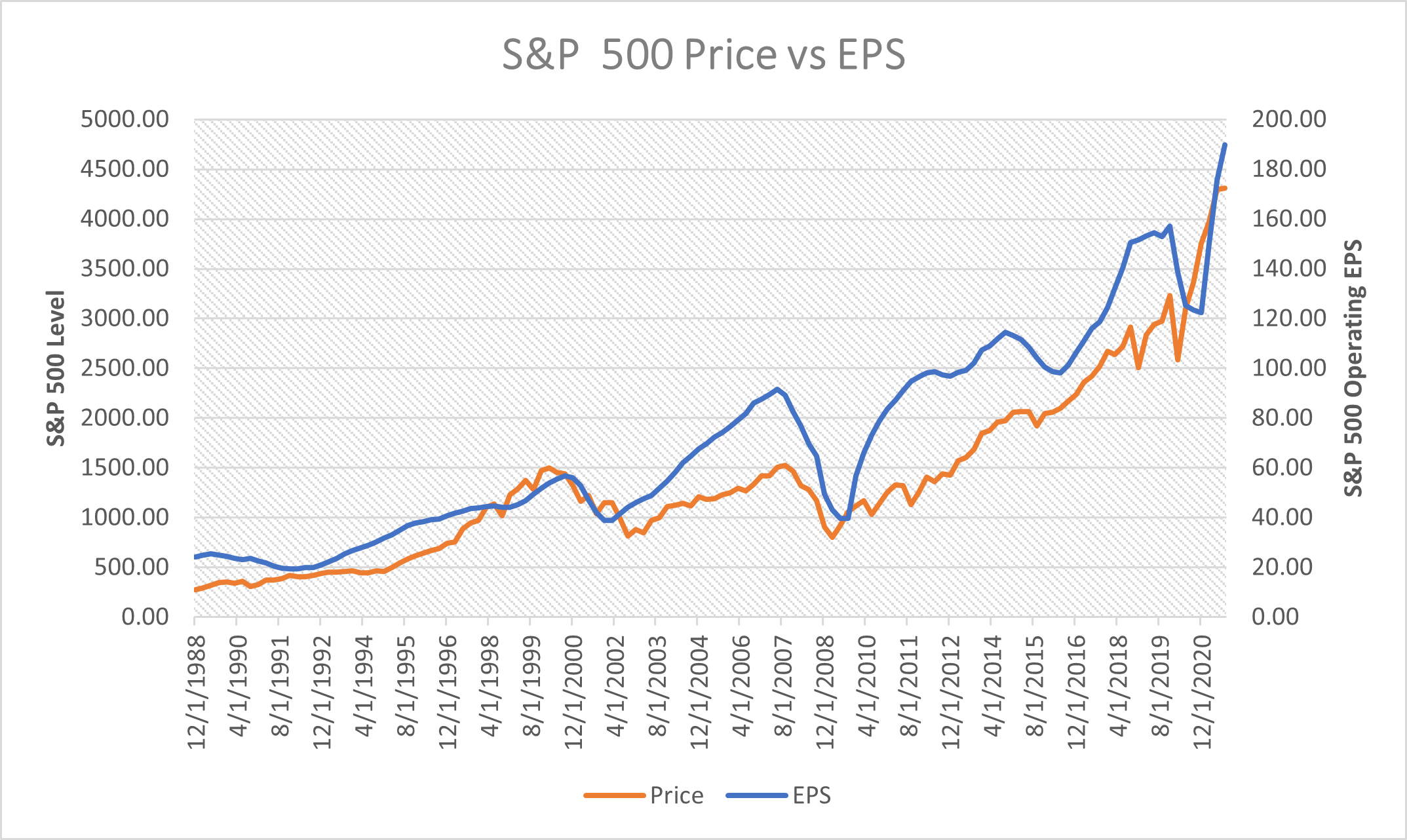

Simply take a look at the next chart. It graphs the earnings per share of the S&P 500 (the blue line) alongside the value of the S&P 500 (the orange line) from 1988 to 2022.

As you may see, the blue line (earnings per share) traces up nearly completely with the orange line (worth). The 2 couldn’t be extra strongly correlated. Certainly, the mathematical correlation between the 2 is 0.93. That’s extremely robust. An ideal correlation is 1. An ideal anti-correlation is -1.

Subsequently, the historic correlation between earnings and inventory costs is about as completely correlated as something will get in the actual world.

In different phrases, you may overlook the Fed. You’ll be able to overlook inflation and geopolitics. You’ll be able to overlook commerce wars, recessions, depressions, and monetary crises.

We’ve seen all of that over the previous 35 years – and but, by all of it, the correlation between earnings and inventory costs by no means broke and even faltered in any respect.

On the finish of the day, earnings drive inventory costs. Historical past is crystal clear on that. In truth, historical past is as clear on that as it’s on something, mathematically talking.

The phenomenon my group and I’ve recognized has to do with this correlation. In truth, it has to do with a “break” on this correlation – a break that traditionally solely arises when recession fears are peaking and has produced the best inventory market shopping for alternatives in historical past.

Nice Divergence Creates Nice Alternatives

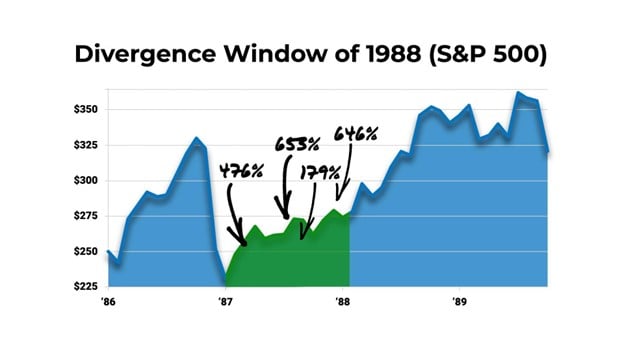

Each every so often – particularly, about as soon as a decade – earnings and revenues quickly cease driving inventory costs.

We name this anomaly a “divergence.”

Throughout these divergences, firms proceed to see their revenues and earnings rise. However as a result of some macroeconomic fears, their inventory costs will quickly collapse. The result’s that an organization’s inventory worth diverges from its elementary progress pattern.

Each time these uncommon divergences emerge, they flip into generational shopping for alternatives. Inventory costs “snap again” to elementary progress tendencies, and buyers who purchased the dip see their returns rocket.

This has occurred time and time once more, like clockwork, all through the market’s historical past.

It occurred within the late 1980s in the course of the Financial savings & Loans disaster. Excessive-quality progress firms – like Microsoft (MSFT) – noticed their inventory costs collapse whereas revenues and earnings stored rising. Traders who capitalized on this divergence doubled their cash in a 12 months and scored a jaw-dropping ~40,000% returns (on common) in the long term.

And it occurred within the early 2000s after the dot-com crash. Excessive-quality progress firms – like Amazon (AMZN) – noticed their inventory costs plunge. However their revenues and earnings stored rising. Traders who capitalized on this divergence greater than doubled their cash in a 12 months and scored greater than 20,000% returns in the long term.

It occurred once more in 2008 in the course of the Nice Monetary Disaster. Excessive-quality progress firms – like Salesforce (CRM) – noticed their inventory costs collapse. However their revenues and earnings stored rising. Traders who capitalized on this divergence nearly tripled their cash in a 12 months and hit 10X returns in simply 5 years.

That is probably the most worthwhile repeating sample in inventory market historical past. And it’s occurring once more proper now for the primary time in 14 years.

The Closing Phrase on Divergence

My group and I perceive that market volatility at all times creates market alternative.

So, amid the market’s wild gyrations of 2022, we’ve made it our prime precedence to analysis market volatility and develop a stock-picking technique to make tons of cash throughout uneven markets.

That led us to creating the most important discovery in InvestorPlace historical past: the existence of uncommon divergence home windows.

These divergence home windows solely seem about as soon as a decade, amid peak market volatility. They open for very temporary moments in time and just for sure shares. However if you happen to capitalize on them – by shopping for the suitable shares at precisely the suitable second – you can also make some huge cash whereas everybody else is struggling to outlive in a uneven market.

Greater than that, these divergence home windows offer you an actual shot at turning $10,000 investments into multi-million-dollar paydays.

The extra we researched these divergence home windows, the extra excited we turned.

However right here’s crucial half: As a result of these alternatives emerge out of concern within the markets – and since we’ve reached peak concern – my group and I’ve concluded that this ultra-rare funding alternative is quickly closing shut.

That is your closing probability to capitalize on what might be the most important funding alternative of your life.

That’s why we’re calling this month the “Zero Hour.” It’s your closing alternative to capitalize on the 2022 divergence.

That will help you try this, we’ve put collectively an emergency broadcast – unsurprisingly dubbed the Zero Hour – to stroll you thru this monumental funding alternative. We’ll go LIVE with that broadcast this Thursday afternoon, at four p.m. EST.

In it, I’ll unveil my No. 1 “late-stage” divergence inventory to purchase proper now – without spending a dime. This can be a inventory that might simply soar lots of of % over the following 12 months alone!

Greater than that, I’ll even give viewers the prospect to entry a brand-new, never-before-seen portfolio of divergence shares set to soar over the following 12 months.

That is actually a broadcast you don’t wish to miss.

Reserve your seat now.

Printed First on InvestorPlace. Learn Right here.

Interior Picture Credit score: Supplied by the Creator; Thanks!

Featured Picture Credit score: Photograph by Kampus Manufacturing; Pexels; Thanks!

The publish How Traders Make Thousands and thousands Amid Volatility appeared first on ReadWrite.