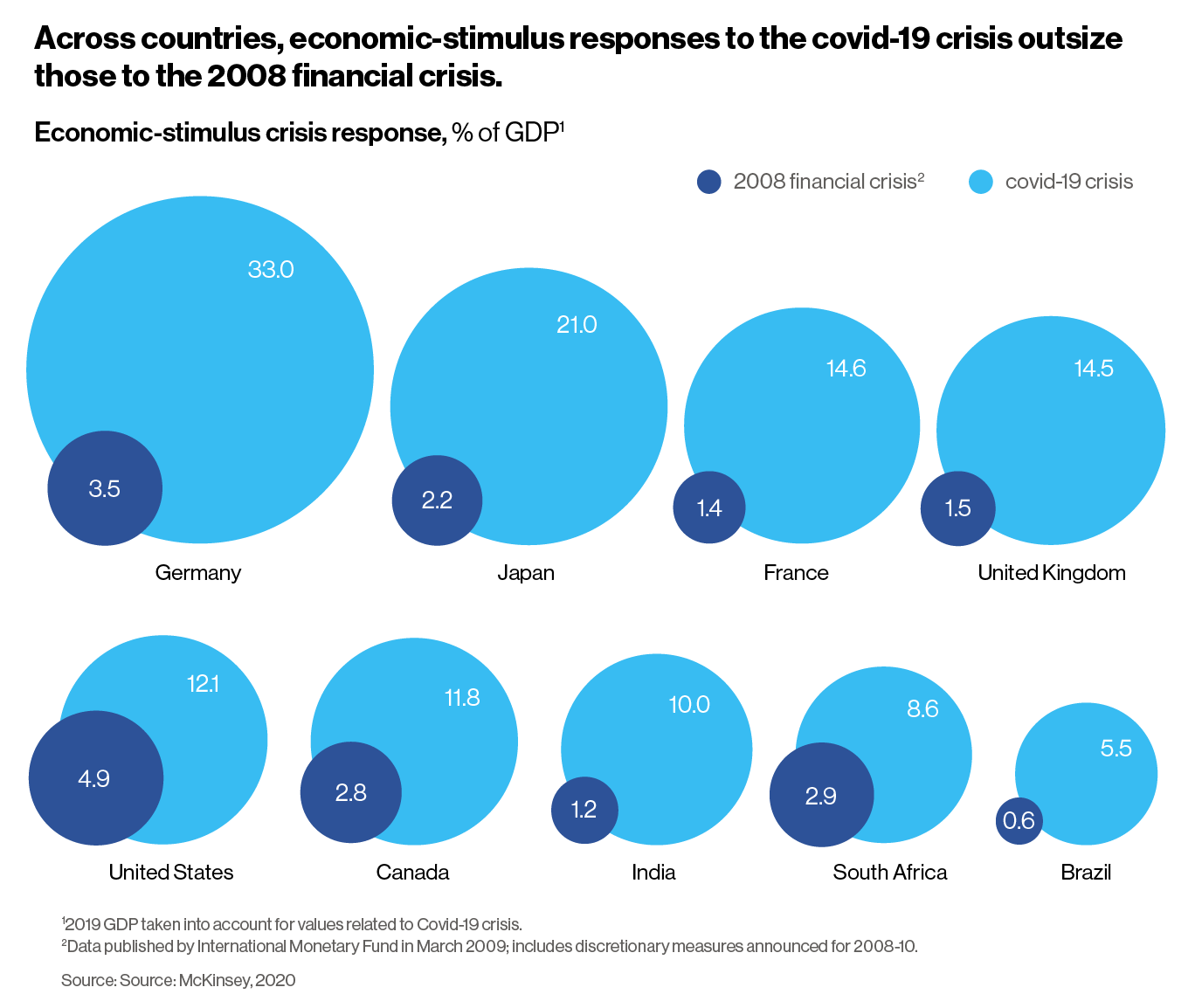

Over the previous six months, central banks and governments have unlocked monetary floodgates to cope with the financial fallout of covid-19. As early as April, 106 international locations had launched or tailored social safety packages, principally money transfers, to assist these affected by the pandemic. A McKinsey evaluation of 54 international locations estimates that governments had dedicated $10 trillion by June, by way of grants, loans, and furlough funds to unemployment advantages and welfare. The portions far outstrip the 2008 monetary disaster (see chart).

Operating parallel to this state spending spree is a full-bodied embrace of digital finance by residents. Paper money and cash are potential vectors for the virus (one municipal authority in India even banned using paper money for house deliveries). The motion to on-line commerce helped thousands and thousands of shoppers develop accustomed to digital spending, and they won’t probably return.

A once-in-a-generation money infusion

Some forward-looking governments and central banks are combining the 2, by utilizing digital expertise to disburse funds, to leverage the velocity and effectivity in addition to to unlock extra knowledge concerning the form of the financial restoration. Experimental policymakers are utilizing this once-in-a-generation money infusion to reimagine how governments make funds to residents.

In Hangzhou, China, municipal authorities are working with Alibaba, headquartered there, to launch a digital-coupon stimulus program by way of the Alipay platform. Coupon-based restoration initiatives should not new—town used a paper scheme throughout the 2008 disaster—however releasing them digitally, in a real-time lottery, permits the federal government to investigate how coupons are spent, unearthing knowledge concerning the financial restoration. Not like paper, digital coupons are versatile; the quantity, worth, and thresholds at which they’re used are adjustable over time, permitting authorities to shift them to sectors most in want. This system has been replicated in additional than 100 cities throughout China.

China was already a frontrunner in digital finance. The digital yuan is on monitor to be the world’s first sovereign digital foreign money and is presently in pilot mode with 4 state-owned business banks. However many different international locations are funneling stimulus funds by way of digital pipes. Malaysia’s federal authorities disbursed $110 million to nearly half the inhabitants by way of three e-wallets—Seize, Increase, and Contact ‘n Go—serving to jumpstart the digital funds business.

Ghana, the primary nation to launch a covid-related digital monetary companies coverage, has eliminated charges on low-value remittances, relaxed transaction and pockets measurement limits for cell cash, enabled authentication processes to be transferable from SIM registrations, and minimize charges on interbank transactions. Neighboring Togo constructed a digital money switch program known as Novissi, offering month-to-month help to casual sector employees. Money transfers are paid out each two weeks right into a cell cash account, at $21 for girls and $19 for males. Regardless of the challenges of reaching beneficiaries who, by definition, lack paperwork and authentication paperwork, the challenge was assembled in simply 10 days, utilizing the nationwide voter database, to serve 12% of the inhabitants. It has since advanced to focus extra on particular elements of the nation, unfolding coverage decisions like district-level motion restrictions.

Simply as Togo used present property such because the voter database, different international locations have constructed covid funds on infrastructures already in place. In Chile, a nationwide ID-linked service, CuentaRut, helps low-income folks, and it has been used to channel funds of the federal government’s “Bono covid-19” emergency help funds into the financial institution accounts of greater than 2 million residents. Peru is scaling up its government-to-citizen system to extend funds to present and new beneficiaries, working with new monetary service suppliers, together with personal banks and cell cash firms.

This all stands in distinction to the US, the world’s largest, most technologically refined economic system, which has remained within the funds darkish ages; an estimated 70 million American households turned to financial institution overdrafts, payday loans, and verify cashers whereas they waited for paper checks to reach within the mail.

Governments are additionally decreasing the frictions, charges, and fees that bathroom down the system. In Italy, from July 2020, retailers beneath a income threshold of €400,000 ($471,000) are entitled to a tax credit score equal to 30% of the commissions on digital funds, whereas Egypt’s central financial institution has raised the restrict for digital funds by way of cell phones for people and firms.

Nongovernmental organizations and firms are serving to. Kenya’s Safaricom has partnered with public transport firms to allow them to settle for cashless funds by way of M-Pesa, the nation’s ubiquitous cell pockets. SumUp, a fintech specializing in cost options for small and medium-sized companies, signed an settlement with the Italian Pink Cross to provide SumUp card readers all through the nation. Paga, a Nigerian cell funds firm, has waived charges for retailers. Something that quickens the motion of cash could have far-reaching results at a time when companies exist on a solvency knife edge.

Hayek, meet Keynes

Untangling the short- from long-term adjustments wrought by covid-19 is tough. Some reforms, equivalent to authorities reimbursement of telehealth consultations, could also be reversed when the disaster abates. However there shall be some basic shifts within the monetary panorama, significantly with the pandemic including momentum to main monetary reforms already underway: the event central financial institution digital currencies (CBDCs).

These digital fiat currencies have many interesting options. They might assist residents extra effectively, rapidly, and flexibly than present approaches like verify funds or tax reduction. They’re programmable and adjustable to regulate how, when, and the place funds are used. A CBDC may perform as an account that an individual holds with a central financial institution, with tech firms, fintechs, or intermediaries growing user-friendly interfaces.

Different advantages embrace the manufacturing of real-time knowledge about financial exercise, extra correct and well timed knowledge for gross home product estimates, near-instantaneous cost settlement, and larger traceability for tackling corruption and monetary crime. CBDCs successfully afford all the effectivity positive aspects of digital finance, equivalent to velocity and lowered processing, with out ceding regulatory controls. They might additionally handle two large issues about personal cryptocurrencies: cash laundering and tax evasion. In truth, they may help treasuries in combatting nonpayment of some taxes, augmenting their revenues.

Finest considered a regulated cryptocurrency, the thought has attracted curiosity from central banks and policymakers within the Netherlands, France, Canada, and Singapore, in addition to the Worldwide Financial Fund. Dutch financial institution ING reckons covid-19 makes CBDCs “extra probably” and the Fb-affiliated Libra Affiliation’s “Plan 2.0,” printed in April 2020, argued that CBDCs may very well be built-in with the Libra international digital foreign money community.

The important thing, says Zhiguo He, Fuji Financial institution and Heller Professor of Finance on the College of Chicago, is to make use of digitally delivered state cash in a classy and market-oriented means. “Authorities-to-person funds are precisely what occurred in 1950-to-1970s China, throughout the deliberate economic system. We all know it went badly and that markets are the answer. Fee itself is subsequently not the important thing for financial stimulation: data is.”

Professor He, who serves on the educational committee of the Luohan Academy, expects social safety and stimulus funds prompted by the pandemic to completely improve the digital supply of government-to-person funds, however he additionally argues that digital currencies are greatest considered as a way, not an finish. “From the angle of an economist, the ‘first greatest’ is to have a system the place we now have all the data to calculate the fiscal multiplier for that individual—how a lot GDP might be generated by giving one greenback to that individual, making an allowance for of financial savings, the products he/she is buying and so forth—and ship the primary greenback to these with the very best multipliers. The digital foreign money itself is only a small a part of this perfect world.”

Policymakers’ first concern is to get monetary help to those that want it. Utilizing digital expertise may assist them not simply give cash away sooner and extra effectively, it may additionally assist them perceive the state of the economic system and alter assist measures to focus on the crucial hassle spots.

______________________________

The Luohan Academy’s mission is to know how digital expertise might help obtain the widespread good and construct a broad tutorial neighborhood for systematic and in-depth analysis into fixing first-order issues within the digital society. Go to the web site for evaluation and concepts protecting points together with pandemic-era policymaking, fintech, and nation evaluation.