Whereas recession dangers are rising and shares are falling, we’re rising very bullish on a specific group of shares out there.

- One of the best factor to do throughout bear markets and crashes is to hunker down in shares that can soar as soon as the downturn passes.

- The Fed is absolutely dedicated to stomping out inflation, however it’ll take quite a lot of price hikes and a few important financial cooling to get there.

- No matter a recession, stable development corporations will proceed to develop their revenues and earnings at a really wholesome price over the subsequent a number of years.

Currently, the inventory market has been getting crushed. It’s clear that we’re in the course of a bear market. And it appears probably that the U.S. will see a recession inside the subsequent 12 months. That’s if it’s not there already.

Which will sound scary. Nevertheless it shouldn’t be.

Recessionary intervals and bear markets create once-in-a-decade shopping for alternatives within the inventory market.

In different phrases, recession dangers are rising, and the broader markets are extremely risky. However we’re rising very bullish on a specific group of shares proper now.

Traditionally, crises have created alternatives. This time is not any totally different. And the alternatives we’re seeing proper now are doubtlessly life-changing.

So, don’t freak out. Don’t run for canopy…

One of the best factor to do throughout bear markets and crashes is to hunker down in shares that can soar as soon as the downturn passes.

Watch the Yield Curve in Bear Markets

There’s some spooky knowledge on the market that means {that a} massive financial slowdown — or worse — has arrived.

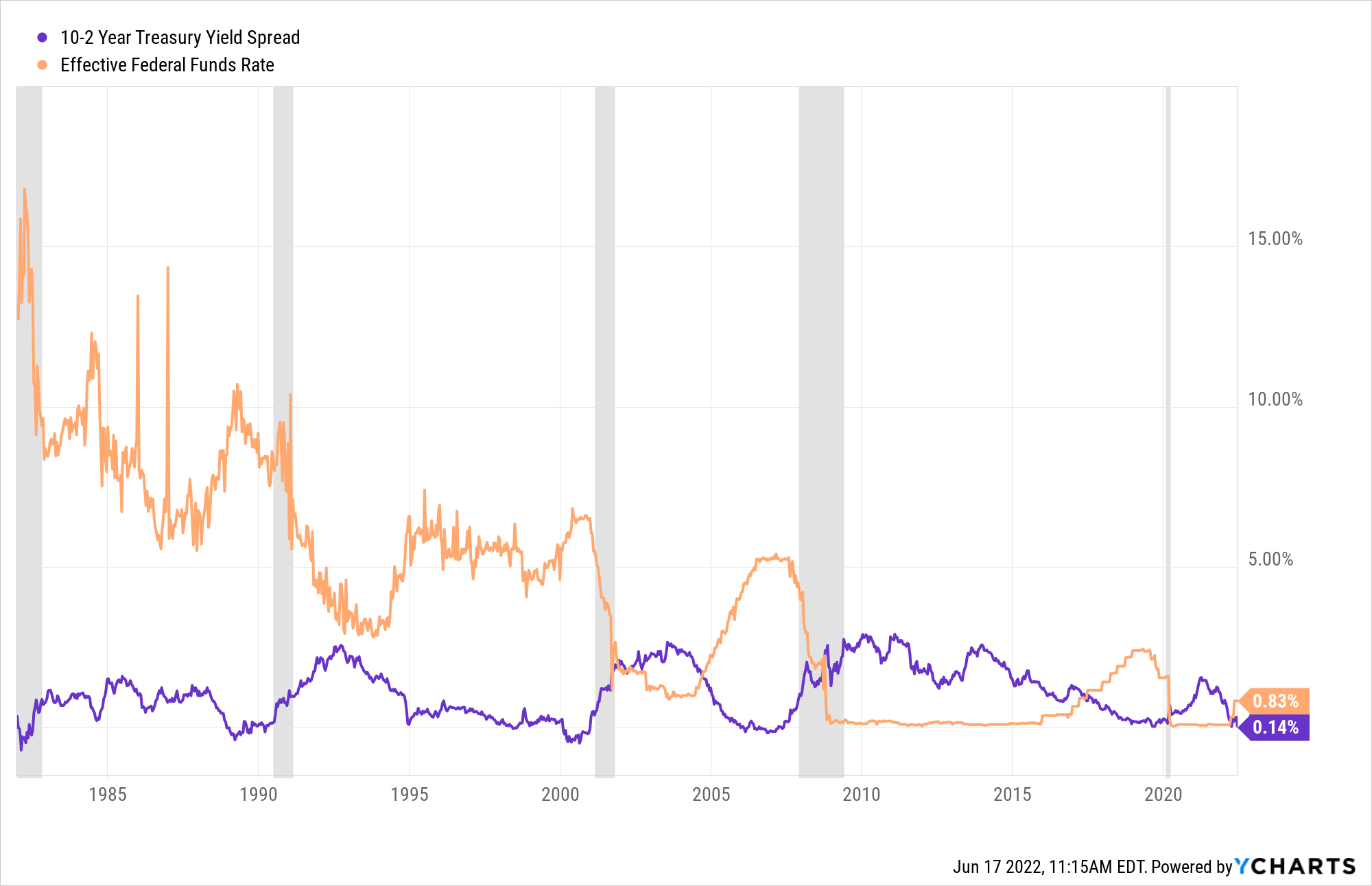

Maybe a very powerful of those knowledge factors is the unfold between the 2- and 10-year Treasury yields. It’s been shrinking quickly over the previous few months. And this previous Monday, June 13, the yield curve briefly inverted minus 2 foundation factors earlier than normalizing.

Recall {that a} flattening yield curve is the bond market saying that an financial slowdown is coming. And a yield curve inversion has preceded each financial recession since 1980.

Since March, we’ve seen a speedy flattening of the yield curve to under 30 foundation factors. That’s a bearish dynamic that’s occurred solely six instances since 1982.

4 of these six occurrences have been adopted by a yield curve inversion inside 12 months. And people inversions subsequently spilled into recessions. Two of these six occurrences have been not adopted by a yield curve inversion (August 1984 and December 1994). Each of these instances, an inversion was averted by the Fed chopping charges.

Nicely, in March, we did see a yield curve inversion. And even nonetheless, the central financial institution has been fairly hawkish.

To get a deal with on runaway inflation, the Federal Reserve is mountaineering charges. And such an unprecedented motion is anticipated to occur alongside a battle in Europe and a slowing labor market. That’s not a bullish setup.

The Fed had its June assembly on Wednesday of this week. The central financial institution hiked charges by 75 foundation factors and signaled for one more potential 75-bps hike in July. It is a Fed that can hike extra now to hike much less later. And it expects the subsequent few massive lifts to efficiently stomp out inflation.

In different phrases, we lastly have visibility to inflation falling to regular ranges. However it’ll take quite a lot of price hikes and a few important financial cooling to get there. And to be frank, a recession is now probably the bottom case.

Sounds scary however it’s not.

How A lot Farther Will Shares Fall?

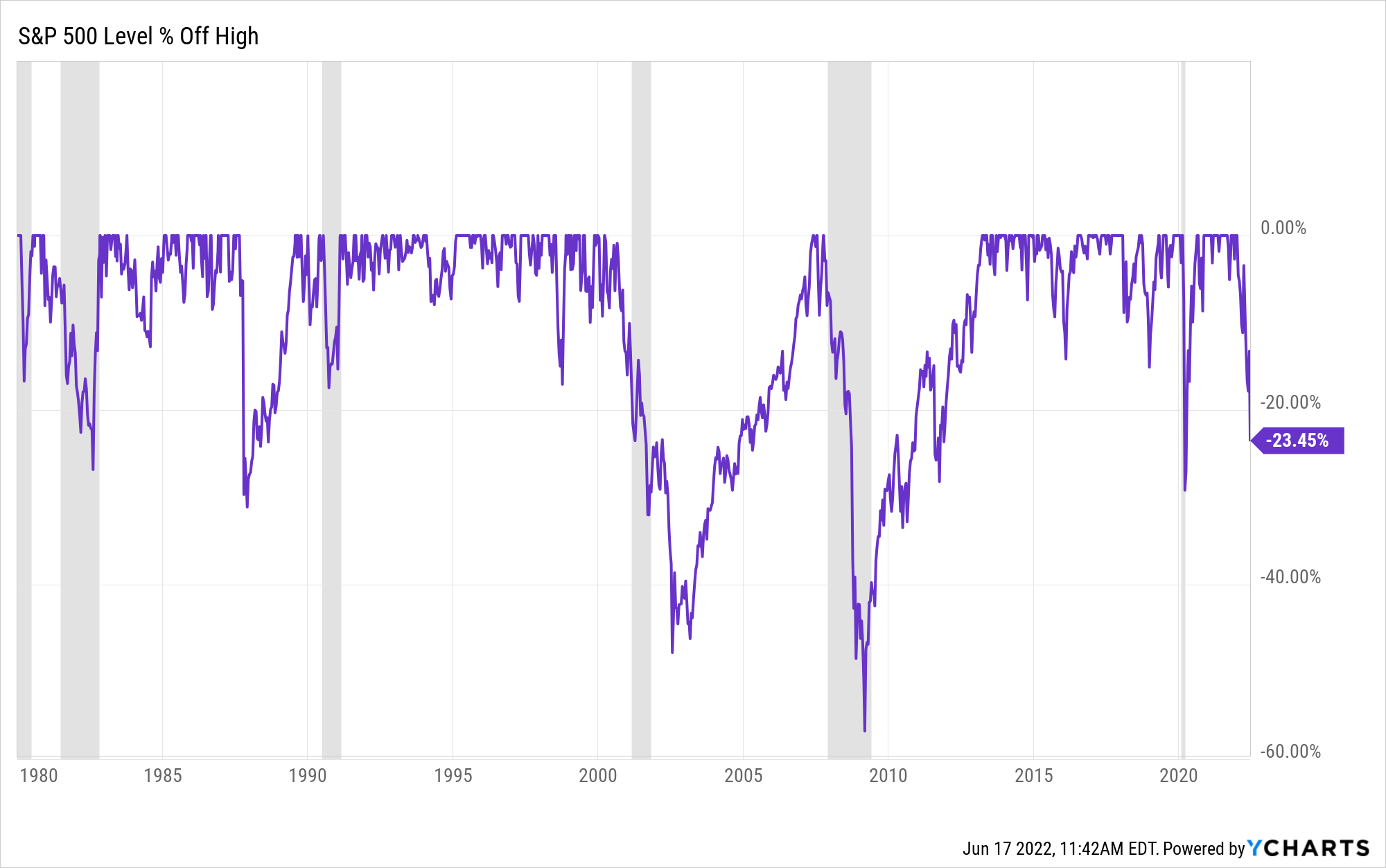

Within the early 1980s, a U.S. financial recession led to only a 15% drawdown in shares. The early 1990s recession equally led to simply an 18% drawdown.

Certain, the early 2000s recessions resulted in a 40% inventory market collapse, whereas the 2008 recession sunk shares by 50%.

However that is not that.

In 2000, we suffered from gross overvaluation. The S&P 500 was buying and selling at 26X ahead earnings, with a 10-12 months Treasury yield above 5%. Right now the market is buying and selling at 22X ahead earnings, with a 10-12 months yield under 3.4%. Right now’s valuation is decrease each in absolute and relative phrases in comparison with what we noticed in 2000.

In the meantime, in 2008, your complete U.S. monetary system was on the snapping point. We don’t have that immediately. Steadiness sheets throughout banks, companies, and households are cash-heavy and really sturdy. Rates of interest are nonetheless comparatively low. We shouldn’t have one other 2008 on the horizon.

So, within the grand scheme of issues, we face what’s going to probably be a shallow recession. It’s more likely to observe these of the early 1980s and early 1990s, when shares dropped round 20- to 30%.

Shopping for the Dip Throughout a Bear Market

Over the previous few months, we’ve seen some sharp drops in shares. And in such an unpredictable local weather, it’s far too early to name a backside within the markets. However we consider that hypergrowth shares are very shut to 1. And now stands out as the time to begin shopping for the dip.

As a result of weaker client confidence results in much less spending. Much less spending results in decrease inflation on the demand facet. This might very effectively be what the Federal Reserve is hoping for. That’s, because the specter of upper charges takes down all property (crypto, equities, housing), client spending is curtailed. And demand hits a slowdown. And that is coinciding with the normalization of worldwide provide chains. Provide spikes, and demand takes a dive.

That’s bullish for a slowdown in inflation.

Nonetheless, client credit score numbers are hitting new highs, which might sign they’re nonetheless spending by maxing out their bank cards. In spite of everything, people nonetheless want meals, housing and transportation. So, spending can solely be curbed by a lot.

So proceed with warning. In case you purchase the dip, ensure that to solely make investments what you possibly can afford to lose. Take a nibble right here and there by cost-averaging down into your positions. If development shares do have additional to fall, the drops can be swift. By cost-averaging, you possibly can restrict your draw back whereas permitting for additional upside when the market rallies once more. Don’t purchase the dip all of sudden.

Development Shares Win As soon as the Crash Passes

On the prime of this be aware, we wrote that we’re very bullish on a sure group of shares on the present second. That group is hypergrowth tech shares.

I do know. Which will sound counterintuitive. However observe me right here…

In our flagship funding analysis product Early Stage Investor, we put money into shares for the long-haul. We’ve recognized a specific group of shares which were unnecessarily battered regardless of sporting rising earnings and revenues. And these shares have an excellent likelihood of snapping again to all-time highs.

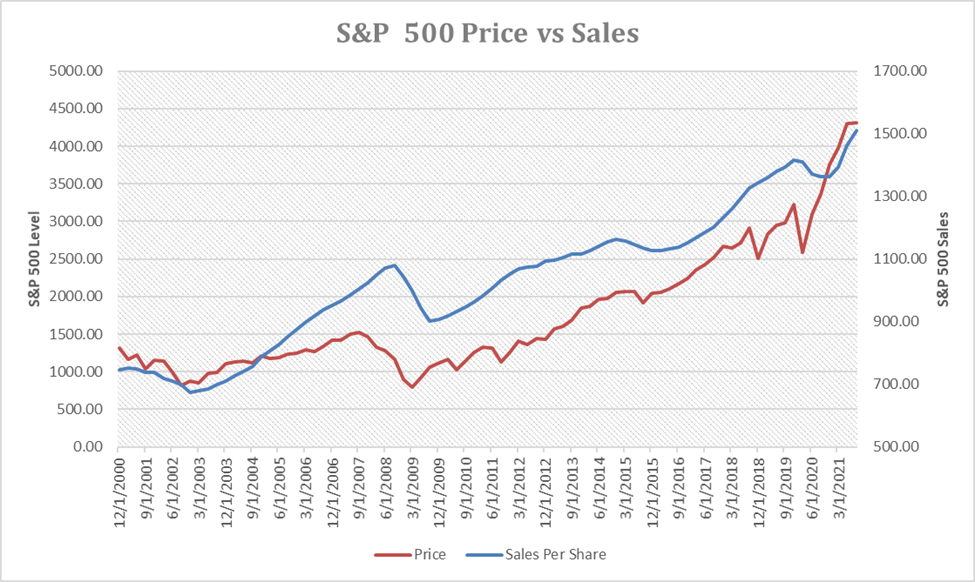

See the chart under, which illustrates the sturdy constructive correlation between S&P 500 value and gross sales. Numerically, it is a constructive correlation of 0.88, or almost completely correlated. You don’t get way more carefully correlated than that in the true world.

No matter a recession, stable development corporations will proceed to develop their revenues and earnings at a really wholesome price over the subsequent a number of years.

In different phrases, their “blue strains” from the above chart will proceed to maneuver up and to the proper. Finally, their “purple strains” — or their inventory costs — will observe go well with.

That’s why we’re very bullish on development shares immediately.

Their blue strains (revenues) proceed to go larger and better, whereas their purple strains (inventory costs) are dropping sharply. That is an irrational divergence that emerges about as soon as a decade throughout instances of financial disaster. And it all the time resolves in a speedy convergence, whereby the inventory costs rally to catch the revenues.

Bear Market Alternative in Development Shares

Regardless of the current market local weather, now shouldn’t be the time to freak out.

Keep in mind: Crises create alternatives. In shares, this has been the case without end. This time shouldn’t be totally different.

And, within the present disaster, the chance is especially giant in development shares. We absolutely consider that after this bear market ends — and it’ll — sure development shares will rattle off 100%, 200%, and even 300%-plus beneficial properties.

The funding implication? It’s time to hunker down within the proper development shares.

Revealed First on InvestorPlace. Learn Right here.

Picture Credit score: by Ketut Subiyanto; Pexels; Thanks!

The submit Energy By means of a Doable Recession With Development Shares appeared first on ReadWrite.